| Posted on | others

Popular Types of Life Insurance Schemes in India

0

4454 Views

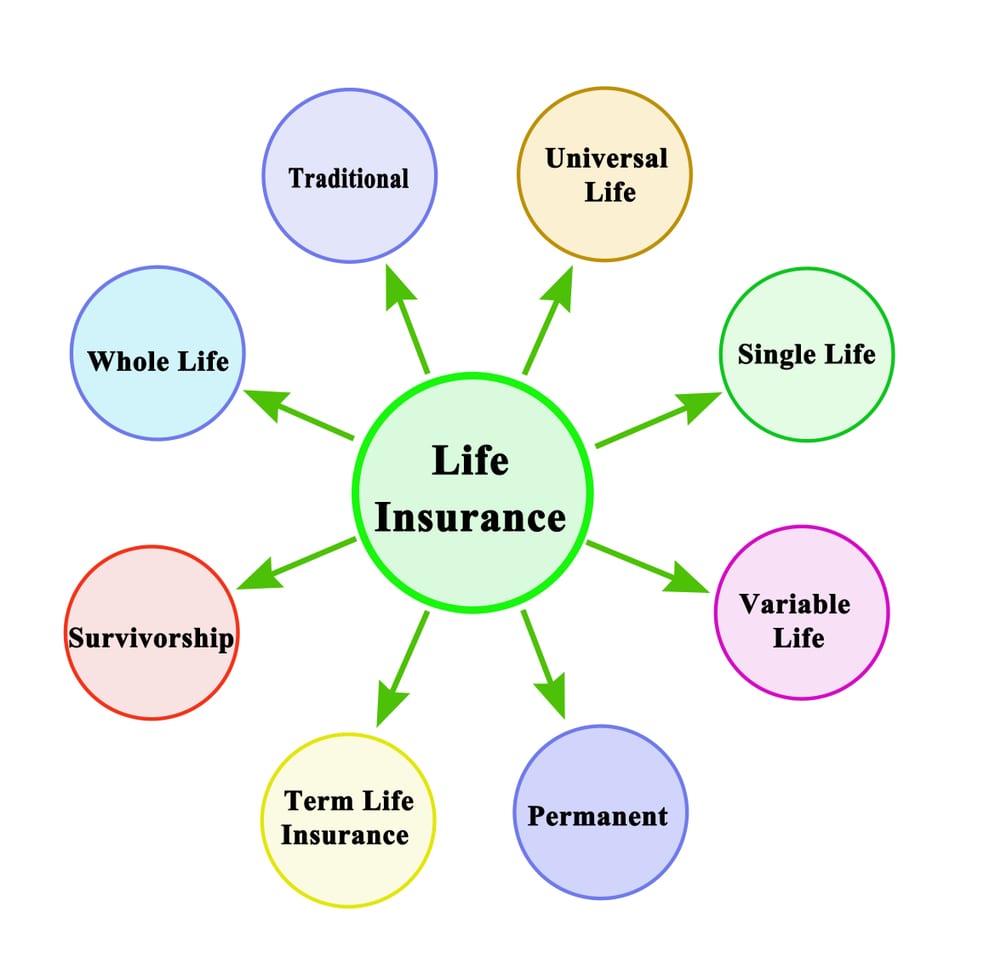

With growing awareness around the financial benefits of having insurance, we have noticed more individuals opting for insurance products in India. This growing interest in insurance has pushed the industry to innovate products and offerings, providing you with multiple types of life insurance schemes to explore. However, with the existence of multiple policies, it is important that you become familiar with the basics of each category so that you can understand which category or scheme type would be the best for your needs.

Types of insurance schemes

These are among the most popular life insurance scheme you will find in India.

- Term insurance

This insurance plan is deemed to be the simplest and purest life insurance policy. Term insurance plans offer death benefits or sum assured to policy beneficiaries, which helps them to account for immediate and subsequent financial obligations and expenses. It would help to fill the income gap left behind by your absence in the event of your sudden death. However, you cannot expect any survival benefit under this plan, unless there is a specific provision for it. Term plans are solely for protection, which is why they come with an affordable premium also making it cheaper than other life insurance schemes. Notably, you can increase the scope of the plan by adding suitable riders to it. However, adding riders to your base term plan will increase your premium, so make sure to add only those riders that are necessary for you.

- Whole Life Insurance Plan

The coverage under this plan will remain in action your whole life, given you pay a premium. Under whole life insurance plans, you can opt for a participating or nonparticipating policy based on your risk-taking capacity and more importantly your financial needs. This is because the premium you will have to pay for participating whole insurance would be more than the nonparticipating option. Then again, you may receive dividends at regular intervals. However, the ultimate will depend on several things including coverage, applicants’ age, health condition, and more. When exploring a term plan you may use a term insurance premium calculator, using which is as simple as any other online tool like an NPS return calculator, FD calculator, etc.

- Money Back Policy

This policy is considered to be among the most popular insurance products today. The USP of this plan is its feature of returning a percentage of the sum assured at regular intervals as survival benefits. On maturity, the remainder sum assured is disbursed to the policyholder. In case the insured dies during the active policy term, their dependents will receive the sum assured without deductions.

- Unit Linked Insurance Plan (ULIP)

ULIPs offer both investment opportunities and protection to policyholders. A part of your premium goes towards insurance coverage while the rest is invested into investment instruments that may be backed by equity funds, debt funds, or securities. The dual benefits of ULIP have made them quite popular among consumers. These insurance plans are flexible as they will allow you to redirect or switch between different funds. Notably, the fact that the proceeds earned on the investment component of ULIPs are exempted from long-term capital gain tax, offers the insurance product an edge over most market-linked instruments.

- Endowment plans

This life insurance plan acts as a potent insurance and savings instrument. The USP of this policy is the maturity benefit that gets disbursed on completion of the term period. However, such a benefit is given when the policyholder outlives the plan. Hence, you may find this plan suitable if you wish to avail yourself of a life protection cover and build a savings avenue. You may find such plans motivating as they facilitate conscious savings while encouraging you to seek life protection against common risks. These plans are further divided into different types, based on your needs you may select one among them.

- Retirement Plan

This insurance plan category has been carefully designed to offer financial stability and independence to individuals after they retire. Post-retirement, investment in retirement plans acts as a substitute for income, offering financial security. Retirement plans can help create a regular source of income and help you lead a comfortable and relaxed life post-retirement without worrying about exhausting limited savings. So, if you were considering retirement planning you may explore retirement plans to create an income stream for later years. Such a provision will also help build a corpus for your dependents and help take care of their financial needs and expenses in your absence. This plan helps develop a disciplined approach towards savings and corpus building for retirement, enabling you to effectively plan retirement over the years. Another important feature of this plan is that they offer death benefits which the policy beneficiary will receive in the event of the death of the insured.

- Child Insurance

This particular insurance plan category comprises the feature of savings and investment. Child insurance plans are designed to offer comprehensive financial protection to safeguard children's future in the event of the sudden demise of the policyholder. Such a plan helps ensure that your child's future is financially secure and their needs are met. This way a child insurance plan can allow you to invest in your child's future and build them a provision upon which they can rely in the face of an emergency. You can also plan specific goals such as a child's higher studies, marriage, or other future obligations through these policies

- Group Insurance

These plans are designed to cover financial coverage to a group of individuals at once. While individual plans secure the financial future of one individual, group insurance plans can cover at least 10 individuals. You will commonly find these insurance plans in banks, offices, etc.

Notably, the features of this life insurance scheme vary greatly, and so do their scope and limitations. Hence, it is suggested that you check the features of the plans to understand which one meets your requirements and would be more suitable for your case. The key is to read the policy document clearly to understand the associated terms and conditions and limitations. This insight will help you make an informed choice and develop suitable insurance strategies.