student | Posted on | Education

What are the Different Types of Accounting?

| Posted on

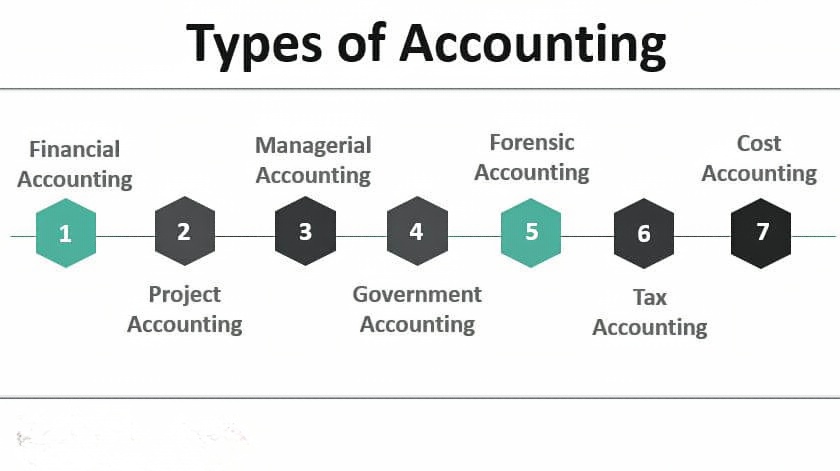

Accounting is a vital function in any organization, serving as the backbone for financial decision-making and compliance. It encompasses a variety of practices and disciplines, each tailored to meet specific needs. In this post, we will explore the different types of accounting, each with its unique purpose and significance in the business world.

1. Financial Accounting

Financial accounting is primarily concerned with preparing financial statements that provide a snapshot of a company's financial health to external stakeholders.

1.1 Definition and Purpose

Financial accounting involves recording, summarizing, and reporting financial transactions over a specific period. The primary goal is to accurately represent an organization’s financial position and performance to external parties such as investors, creditors, and regulatory agencies.

1.2 Key Financial Statements

The main financial statements produced through financial accounting include:

- Balance Sheet: A snapshot of an organization's assets, liabilities, and equity at a specific point in time.

- Income Statement: The profit and loss statement summarizes revenues and expenses over a period to show net income or loss.

- Cash Flow Statement: This statement provides insights into cash inflows and outflows from operating, investing, and financing activities.

Each of these statements plays a crucial role in evaluating a company's financial health.

1.3 Importance for Stakeholders

Financial statements are essential for stakeholders who rely on accurate information for decision-making. Investors use these reports to assess the viability of their investments, while creditors evaluate the creditworthiness of businesses before extending loans.

2. Management Accounting

Management accounting focuses on providing internal management with relevant financial information for strategic decision-making.

2.1 Definition and Role

Management accounting involves analyzing financial data to aid internal management in planning, controlling operations, and making informed decisions. Unlike financial accounting, which is primarily historical, management accounting emphasizes future projections.

2.2 Tools and Techniques

Key tools used in management accounting include:

- Budgeting: Establishing financial plans for future periods.

- Forecasting: Predicting future revenues and expenses based on historical data.

- Variance Analysis: Comparing actual performance against budgeted figures to identify discrepancies.

These tools help management make informed decisions that align with organizational goals.

2.3 Case Studies

For example, a manufacturing company may use management accounting techniques to analyze production costs closely. By identifying inefficiencies in the production process through variance analysis, management can implement changes that lead to significant cost savings.

3. Cost Accounting

Cost accounting analyzes production costs to help organizations improve profitability and efficiency.

3.1 Definition and Objectives

Cost accounting focuses on capturing all costs associated with production processes to understand where money is being spent. Its objectives include controlling costs, setting prices, and improving profitability.

3.2 Types of Cost Accounting Methods

Common methods include:

- Job Order Costing: Tracking costs for specific jobs or batches.

- Process Costing: Averaging costs over large quantities of identical products.

- Activity-Based Costing (ABC): Allocating costs based on activities that drive expenses.

Each method provides unique insights into cost structures.

3.3 Real-world Applications

A company may use job order costing when producing custom products. By accurately tracking costs associated with each job, management can determine pricing strategies that ensure profitability while remaining competitive.

4. Tax Accounting

Tax accounting ensures compliance with tax laws while optimizing tax liabilities for individuals and organizations.

4.1 Overview of Tax Regulations

Tax accountants specialize in understanding complex tax regulations at local, state, and federal levels. They ensure that individuals and businesses comply with tax laws while maximizing deductions and credits available to them.

4.2 Tax Planning Strategies

Effective tax planning involves strategies such as:

- Timing income and expenses to minimize tax liabilities.

- Taking advantage of tax credits.

- Utilizing retirement accounts for tax deferral.

These strategies help individuals and businesses manage their tax burdens effectively.

4.3 Importance of Accurate Reporting

Accurate tax reporting is crucial; mistakes can lead to audits or penalties from tax authorities. Tax accountants play a vital role in ensuring compliance while minimizing risks associated with inaccurate reporting.

5. Auditing Accounting

Auditing involves examining financial records to ensure accuracy and compliance with established standards.

5.1 Types of Audits

There are several types of audits:

- Internal Audits: Conducted by an organization's own staff to assess internal controls.

- External Audits: Performed by independent auditors who evaluate the accuracy of financial statements.

- Forensic Audits: Investigate suspected fraud or financial discrepancies.

Each type serves distinct purposes within an organization’s governance structure.

5.2 The Audit Process

The audit process typically involves several steps:

- Planning: Setting objectives and determining the scope of the audit.

- Fieldwork: Gathering evidence through testing transactions and reviewing documentation.

- Reporting: Presenting findings in an audit report that outlines any discrepancies or areas for improvement.

5.3 Significance of Auditing for Organizations

Auditing enhances transparency by assuring that financial statements are accurate and compliant with regulations, fostering trust among stakeholders.

6. Forensic Accounting

Forensic accounting investigates financial discrepancies for legal purposes, often involving fraud detection.

6.1 Definition and Scope

Forensic accounting combines accounting skills with investigative techniques to uncover fraud or misconduct within an organization’s finances.

6.2 Techniques Used in Forensic Accounting

Common techniques include:

- Data Analysis: Using software tools to analyze large volumes of data for anomalies.

- Interviews: Conducting interviews with employees or stakeholders involved in suspicious activities.

- Document Examination: Reviewing contracts, invoices, or other documentation for inconsistencies.

These techniques help forensic accountants gather evidence needed for legal proceedings.

6.3 High-profile Cases

Notable cases such as the Enron scandal highlight the importance of forensic accounting in detecting fraud before it escalates into larger issues affecting shareholders and employees alike.

7. Government Accounting

Government accounting manages public funds while ensuring accountability in public spending.

7.1 Overview of Governmental Accounting Standards

Governmental accounting follows specific standards such as Generally Accepted Accounting Principles (GAAP) tailored for public sector entities to ensure transparency and accountability in managing taxpayer dollars.

7.2 Role of Government Accountants

Government accountants are responsible for tracking public funds, preparing budgets, conducting audits, and ensuring compliance with regulations governing public finance management.

7.3 Importance of Public Trust

Effective government accounting fosters trust among citizens by ensuring that public funds are used efficiently and transparently, ultimately contributing to better governance.

8. International Accounting

International accounting addresses global standards and practices necessary for multinational corporations operating across borders.

8.1 Global Accounting Standards

Key frameworks like International Financial Reporting Standards (IFRS) guide international accounting practices by providing consistency in financial reporting across countries.

8.2 Challenges in International Accounting

Accountants face challenges such as differing regulatory environments, currency exchange rate fluctuations, and cultural differences affecting business practices when operating globally.

8.3 Case Studies of Multinational Corporations

For instance, a multinational corporation may need to consolidate its financial statements from subsidiaries operating under different regulatory frameworks into one coherent report compliant with IFRS standards—highlighting the complexities involved in international accounting practices.

9. Environmental Accounting

Environmental accounting evaluates the economic impacts of environmental decisions made by organizations.

9.1 Definition and Relevance

Environmental accounting focuses on incorporating environmental costs into financial reporting to assess sustainability initiatives' economic impacts effectively.

9.2 Tools for Environmental Accounting

Methods such as life cycle costing (LCC) allow organizations to evaluate the total cost associated with a product's lifecycle—from production through disposal—enabling better decision-making regarding sustainability efforts.

9.3 Case Studies on Sustainability Reporting

Companies like Unilever have successfully utilized environmental accounting principles to enhance their sustainability reporting practices, demonstrating accountability toward environmental impacts while appealing to socially conscious consumers.

10. Nonprofit Accounting

Nonprofit accounting tracks funds while ensuring compliance with regulations specific to nonprofit organizations.

10.1 Unique Aspects of Nonprofit Accounting

Nonprofit organizations operate differently than for-profit entities; they focus on fund tracking rather than profit maximization—requiring specialized knowledge regarding donor restrictions and grant compliance requirements.

10.2 Importance of Transparency

Transparency is critical in nonprofit accounting; clear reporting helps maintain donor trust by demonstrating responsible stewardship over contributed funds while ensuring compliance with regulatory requirements governing nonprofits’ operations.

10.3 Examples of Best Practices

Best practices include implementing robust internal controls over fund management processes—ensuring timely reporting on expenditures against budgets—to enhance operational effectiveness within nonprofits while building credibility with stakeholders.

Conclusion

Understanding the various types of accounting is essential not only for professionals in the field but also for stakeholders who rely on accurate financial information for decision-making purposes across different sectors—each type serving distinct yet interconnected roles within an organization’s overall framework! By grasping these nuances better equipped individuals can navigate today’s complex business landscape more effectively!

0

0 Comment

| Posted on

The article explains the different types of accounting practices, such as financial, managerial, cost, tax, forensic, and auditing accounting. It details how each type serves distinct purposes for businesses, including tracking financial transactions, analyzing costs, ensuring tax compliance, investigating fraud, and ensuring financial integrity.

0

0 Comment

| Posted on

It is the field of accounting that describes a systematic procedure which can be divided into recording, classifying, summarizing and interpreting/analyzing financial transactions for decision making purposes. There are different kinds of accounting, and each is meant to serve the needs of a given group of people.

Financial accounting is the process of preparing financial statements for a business entity or any other entity which are used by investors, creditors and other external stakeholders to evaluate the entity’s financial results of operations, financial position and cash flows and to make decisions about resource allocation (i.e. to decide where they should allocate resources among a group of entities)”. -Financial Accounting Theory, Craig Deegan.

Managerial accounting, on the other hand, is designed for management internal use. It provides detailed financial and nonfinancial information about everything within an organization, including individual product/product-line costs; the performance of each department in a business; and the organization as a whole. Managerial accountants use tools such as cost-volume-profit (CVP) analysis, budgeting (entity-wide operating budgets, capital expenditure budgets, etc.), variance analysis, and the like to provide managers with enough information to make informed business decisions.

There is a branch of accounting that is more specialized called cost accounting which is used to determine the cost of producing goods or services. It entails tracking and assigning costs to different products, departments or projects. The information on cost accounting is employed in pricing decisions, inventory valuation, and performance evaluation.

Tax accounting is all about preparing and filing of tax returns for individuals and businesses. Tax accountants ensure compliance with the tax laws and regulations and help in reducing the tax liabilities. They do analysis of financial transactions to discover the deductions as well as credits for taxes.

As part of auditing a firm, its financial statements and records are checked to see if they are correct or not. Auditors do this by verifying the financial information with the help of the tests on transactions and balances. They provide an independent opinion with regards to reliability and fairness of the information system.

Not-for-profit accounting is a type of accounting that is specifically designed for entities that do not operate with the goal of making money. This includes various types of organizations such as charities, non-governmental organizations (NGOs), or educational entities, and which instead focus on reporting financial performance and accountability in relation to donors and government agencies, among other stakeholders.

Government accounting concerns the financial management of government entities at all levels of government including federal, state, and local governments. It encompasses tracking government revenues and expenditures, preparing financial statements and ensuring compliance with government accounting standards.

On top of there regular types of accounting, there are people that work in a specific field and become specialists in areas like forensic accounting, environmental accounting and much more.

0

0 Comment