| Posted on

Introduction to TCS Tax

Tax Collected at Source (TCS) is a critical component of the Indian taxation system, ensuring that certain transactions contribute to the national revenue from the outset. While the concept might seem technical, TCS plays a vital role in maintaining a steady flow of income for the government by collecting tax at the point of sale. This tax is directly linked to specific goods and services, making it an important aspect of the broader tax regime in India. Understanding TCS is essential for both businesses and consumers, as it affects various transactions and has implications for compliance and cost.

Understanding the Concept of TCS

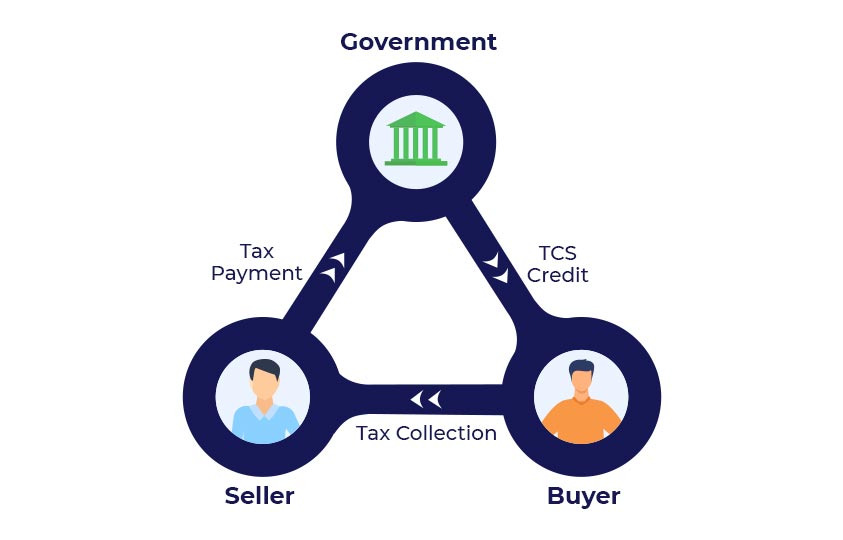

TCS refers to the tax that a seller is required to collect from the buyer at the time of sale of specific goods and services, as per the provisions outlined in the Income Tax Act. This tax is collected over and above the price of the goods or services, and the seller must deposit it with the government. TCS is distinct from other forms of taxation, such as GST or income tax, in that it is collected at the point of sale, rather than at the point of income or consumption.

The primary objective of TCS is to ensure that tax is collected on transactions that are prone to evasion or that involve substantial amounts of money. By collecting tax at the source, the government reduces the likelihood of tax evasion and ensures that certain high-value transactions are taxed appropriately. This mechanism also simplifies tax collection by placing the responsibility on the seller, who is in a better position to ensure compliance.

Legal Framework and Applicability

The legal basis for TCS lies in Section 206C of the Income Tax Act, which delineates the goods and transactions subject to this tax. The law mandates that sellers must collect TCS at the time of sale of specified goods and deposit it with the government within a stipulated time frame. Failure to comply with these provisions can result in penalties and interest charges.

TCS applies to a wide range of goods and services, including alcohol, forest produce, scrap, and minerals. In addition to these, the government has recently expanded the scope of TCS to include transactions such as overseas remittances and e-commerce transactions. The applicability of TCS is determined by the nature of the goods or services being sold, as well as the identity of the buyer and seller. For instance, TCS is generally applicable when goods are sold to consumers or traders, but certain exemptions may apply if the buyer is a government entity or if the goods are being sold for manufacturing or production purposes.

Categories of Transactions Subject to TCS

Not all transactions are subject to TCS; the tax applies to a specific list of goods, such as alcohol, forest produce, scrap, and more. Each of these categories has its rate of TCS, which is determined by the government. For example, TCS on the sale of alcohol is higher than TCS on the sale of scrap metal. The rationale behind these varying rates is to account for the different levels of profit margins and the potential for tax evasion associated with each category.

In addition to the traditional categories, the government has also introduced TCS on new types of transactions, such as the sale of motor vehicles above a certain value, overseas remittances, and payments made through e-commerce platforms. These additions reflect the government’s efforts to adapt the TCS regime to the changing economic landscape and to capture tax revenue from emerging sectors of the economy.

Rates and Calculation of TCS

The rate at which TCS is collected varies depending on the type of goods or services being sold, with rates predefined by the government. For instance, TCS on the sale of timber obtained under a forest lease is 2.5%, while TCS on the sale of scrap is 1%. These rates are applied to the sale price of the goods or services, excluding any other taxes or charges.

To calculate TCS, the seller must first determine the sale price of the goods or services and then apply the applicable TCS rate. For example, if the sale price of scrap metal is ₹1,00,000, and the TCS rate is 1%, the TCS amount would be ₹1,000. The seller would then collect a total of ₹1,01,000 from the buyer, including the TCS amount, and deposit the TCS with the government.

It is important to note that the responsibility for calculating and collecting TCS lies with the seller, who must ensure that the correct amount is collected and deposited on time. Any errors in calculation or payment delays can result in penalties and interest charges.

TCS Compliance and Filing Requirements

Compliance with TCS involves not just the collection of tax, but also its timely deposit with the government and the filing of returns as mandated by law. Sellers who are required to collect TCS must register with the tax authorities and obtain a Tax Collection Account Number (TAN). This TAN is used for all TCS-related transactions and filings.

Once TCS is collected, the seller must deposit the tax with the government within a specified period, typically within one week of the end of the month in which the tax was collected. The seller must also file quarterly TCS returns, providing details of the tax collected and deposited. These returns are used by the tax authorities to verify that the correct amount of TCS has been collected and deposited.

In addition to filing returns, sellers must also issue TCS certificates to buyers, confirming that the tax has been collected and deposited. These certificates are important for buyers, as they can be used to claim credit for the TCS amount when filing their income tax returns.

Recent Amendments and Updates in TCS

In recent years, the TCS regime has seen several amendments, particularly with the inclusion of overseas remittances and e-commerce transactions under its ambit. These changes reflect the government’s efforts to broaden the scope of TCS and to capture tax revenue from new and emerging sectors of the economy.

One of the most significant recent amendments is the introduction of TCS on overseas remittances under the Liberalized Remittance Scheme (LRS). Under this scheme, TCS is applicable on remittances exceeding ₹7 lakh in a financial year, at a rate of 5%. This amendment was introduced to ensure that high-value remittances are taxed and to discourage the use of LRS for tax evasion.

Another important update is the inclusion of e-commerce transactions under the TCS regime. E-commerce operators are now required to collect TCS on payments made to sellers using their platforms, at a rate of 1%. This amendment was introduced to capture tax revenue from the rapidly growing e-commerce sector and to ensure that online transactions are taxed like traditional transactions.

Impact of TCS on Businesses and Consumers

For businesses, TCS represents an additional compliance burden, while for consumers, it often translates into higher upfront costs during the purchase of certain goods. From a business perspective, TCS requires sellers to invest in systems and processes for calculating, collecting, and depositing the tax. This can be particularly challenging for small and medium-sized enterprises (SMEs) that may lack the resources to manage these tasks effectively.

For consumers, the impact of TCS is felt in the form of higher costs for certain goods and services. Since TCS is collected at the point of sale, it is often passed on to consumers as part of the purchase price. This can make certain goods, such as motor vehicles or overseas remittances, more expensive for consumers. However, consumers can claim credit for the TCS amount when filing their income tax returns, which helps to mitigate the impact to some extent.

Despite these challenges, TCS also offers benefits for businesses and consumers. For businesses, TCS helps to ensure that they are compliant with tax laws and avoid penalties for non-compliance. For consumers, TCS provides a mechanism for ensuring that high-value transactions are taxed appropriately, helping to prevent tax evasion and ensuring that the tax burden is shared fairly.

TCS vs. TDS: Key Differences

While TCS is collected by the seller, Tax Deducted at Source (TDS) is a similar mechanism where the payer deducts tax before making certain payments. Both TCS and TDS are pre-paid taxes, meaning that they are collected before the income or transaction is fully realized. However, there are key differences between the two that are important to understand.

The primary difference between TCS and TDS is the point at which the tax is collected. TCS is collected by the seller at the time of sale, while TDS is deducted by the payer at the time of payment. This means that TCS is generally applicable to the sale of goods, while TDS applies to payments for services, salaries, interest, and other types of income.

Another key difference is the rate at which the tax is collected. TCS rates are generally lower than TDS rates, reflecting the different nature of the transactions involved. For example, TCS on the sale of scrap is 1%, while TDS on payments to contractors is typically 10%.

Despite these differences, both TCS and TDS serve a similar purpose: to ensure that tax is collected on certain transactions before the income or transaction is fully realized. This helps to reduce the risk of tax evasion and ensures that the tax burden is distributed fairly across different types of transactions.

Conclusion: Importance of Understanding TCS

A clear understanding of TCS is essential for both businesses and consumers to ensure compliance and avoid penalties, making it a crucial aspect of financial literacy in India. For businesses, understanding TCS is important for managing compliance obligations and avoiding penalties for non-compliance. For consumers, understanding TCS is important for managing the cost of certain goods and services and for claiming credit for TCS amounts when filing income tax returns. In an increasingly complex tax environment, TCS plays a vital role in ensuring that tax is collected on certain high-value transactions and that the tax burden is shared fairly across different sectors of the economy.

0

0 Comment

| Posted on

TCS (Tax Collected at Source): A Comprehensive Guide

Tax Collected at Source (TCS) is a tax system in India that requires the buyer to collect the tax from the buyer at the point of sale. The concept of TCS is governed by the Income Tax Act, 1961 under Section 206C and applies to specified goods, transactions, and services. This tax is collected by the consumer or service provider and remitted to the government. In this guide, we will explore the details of TCS, its application, rates, and the latest updates as per the current Indian tax laws.

1. Understand the purpose of TCS

TCS is a type of tax that is collected by the seller from the seller at the time of the transaction. The tax collected is remitted to the government. This concept is based on the principle that certain transactions, especially those involving certain goods or services, are taxed because of their high value or commercial nature.

In TCS transactions, the customer must pay the price of goods or services with TCS. The customer is responsible for depositing the collected TCS to the Tax Department. The TCS amount credited to the customer's account can be claimed as a tax credit while filing the customer's tax return.

2. Goods and Transactions Covered by TCS

TCS applies to a wide range of specified goods and transactions. The Income Tax Act has made it clear that TCS units should be collected. Following are some of the key transactions for which TCS is applicable:

- Sale of alcohol for human consumption: TCS is collected at the time of sale of alcohol.

- Sale of Tendu leaves: Tendu leaves used to make bidi come under TCS.

- Stock purchase: stock and products related to the TCS bidding process.

- Sale of minerals: The sale of minerals like coal, coal, and iron comes under TCS.

- Smart Sale: When coins are sold, TCS is collected from the transaction amount.

- Sale of motor vehicles: TCS is eligible for sale of motor vehicles valued at more than Rs.10 million.

- Foreign Remittances: Transactions related to foreign travel, education abroad, and foreign remittances above certain thresholds will be subject to TCS under the Scheme Remittance Liberalized Remittance Scheme (LRS).

3. TCS Rates

The rates at which TCS is collected vary depending on the type of goods or services sold. Below is a table of some important TCS rates applicable under the Income Tax Act:

4. Latest Updates and Changes

Introduction of TCS on foreign currency remittances and Travel packages foreign:

One of the latest TCS updates is Can be used for foreign exchange and foreign travel accounts. The Finance Bill 2020 introduced provisions whereby TCS would be collected at the rate of 5% on foreign remittances above Rs 7 lakh in a financial year under the Guarantee Scheme Validation (LRS). This includes expenses such as travel abroad, education, and investment abroad. For example, if a person spends Rs 10 lakh for his child's education abroad, TCS will be levied at 5% of the amount exceeding Rs 7 lakh, in this case, Rs 3 lakh.

For overseas travel vouchers, the TCS fee is fixed at 5% irrespective of the amount spent. The purpose of this measure is to reduce indirect spending abroad and increase the tax base.

Increase in TCS rate on certain transactions (from October 2023)

In the recent reforms, the government has proposed to increase the TCS rate on certain foreign exchange transactions. From October 2023, the TCS rate on foreign exchange for investment in shares, property, and other foreign assets under LRS has been increased to 20%. However, loans given for educational and medical purposes will continue to attract a TCS rate of 5%.

.jpg)

5. Acceptance and Delivery of TCS

The TCS collected by the trader must be submitted to the authorities on the specified dates. The customer should be required to file quarterly TCS returns using Form 27EQ, which provides details of transactions and the amount of TCS collected. Failure to submit TCS or return files within the deadlines will result in penalties.

Merchants who fail to comply will be subject to the following:

Late Payment Charges: If the TCS amount is not remitted on the due date, interest will be charged at 1% per month.

Penalty for non-filing of return: A penalty of Rs.100 per day is applicable for non-filing of TCS return, subject to the amount of TCS.

Once the TCS is issued, the customer can claim it as a credit while filing the tax return, which helps reduce the overall tax liability.

6. Not from TCS

Some transactions with customers are not from TCS. These include:

- Purchases from Central and State Governments: Purchases to Central or State Governments are not subject to TCS.

- Known transactions: Purchases from agencies such as carriers, municipalities, and other designated agencies may be available.

- Public Works: Works related to public sector undertakings (PSUs) can also be exempted from TCS.

Furthermore, if the buyer furnishes a declaration in Form 27C that the goods were purchased for manufacturing or processing purposes and not for trade. In that case, the customer will be exempted from collecting TCS.

7. Conclusion: Importance of TCS in the Indian Tax System

TCS is very important in ensuring tax compliance in high-value transactions and related sectors. tax avoidance. By collecting taxes at the source, governments ensure that buyers and sellers remain responsible for their taxes. Although TCS may seem like an additional financial burden, it is a tax that is credited to the customer's account and can be paid against the entire taxable income.

0

0 Comment